Conservative

The Conservative Portfolio is perfect for risk-averse investors: those who want to limit their month-to-month portfolio volatility and avoid big drawdowns. This is great for those who are saving up for a big purchase soon (e.g. a down payment), or are close to retirement age. It also has the longest history of supporting evidence - the backtests go back to the year 2000, and its track record of escaping 3 different market crashes relatively unscathed (DotCom Crash, Great Financial Crisis, Covid-19 Pandemic) speaks for itself.

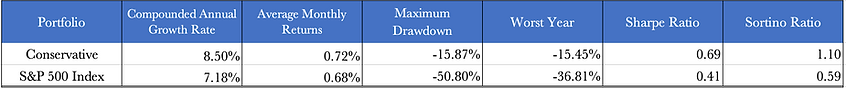

While great at minimizing losses, the Conservative Portfolio also excels at capturing most (if not all) of the gains of the S&P 500 Index. Its CAGR, or Compounded Annual Growth Rate, is 8.50% compared to SPY's 7.18%, and its maximum drawdown is only 15.87% compared to SPY's whopping 50.80%. The graph below is provided by PortfolioVisualizer.com and is plotted month-to-month from Jan 2000 to Jan 2024: 24 years of data.

ETF Exposure

The Global Industry Classification Standard has assigned every large company to a specific economic sector that best defines its business operations. The Conservative Portfolio invests in 8 of the 11 total market sectors that make up the S&P 500 Index, since these 8 ETFs have the longest history as independently tradeable assets in US markets. The Conservative Model switches between these 8 and Cash (or an 'analog' called BIL, a 1-3 month Treasury Bill ETF) during especially volatile periods.

The 9 assets in detail, with information provided by Investopedia and State Street Global Advisors:

The technology sector is the category of stocks relating to the research, development, or distribution of technologically based goods and services. This sector contains businesses revolving around the manufacturing of electronics, creation of software, computers, or products and services relating to information technology.

The financial sector is a section of the economy made up of firms and institutions that provide financial services to commercial and retail customers. This sector comprises a broad range of industries including banks, investment companies, insurance companies, and real estate firms.

The healthcare sector consists of businesses that provide medical services, manufacture medical equipment or drugs, provide medical insurance, or otherwise facilitate the provision of healthcare to patients.

Consumer discretionary is a term that describes goods and services that consumers consider non-essential but desirable if their available income is sufficient to purchase them. Examples of consumer discretionary products and services can include durable goods, high-end apparel, entertainment, leisure activities, and automobiles.

Companies that supply these types of goods and services are usually either called consumer discretionaries or consumer cyclicals.

The term consumer staples refers to a set of essential products used by consumers. This category includes things like foods and beverages, household goods, and hygiene products as well as alcohol and tobacco. These goods are those products that people are unable or unwilling to cut out of their budgets regardless of their financial situation.

Consumer staples are considered to be non-cyclical, meaning that they are always in demand, year-round, no matter how well the economy is—or is not—performing. As such, consumer staples are impervious to business cycles. Also, people tend to demand consumer staples at a relatively constant level, regardless of their price.

The industrial goods sector includes stocks of companies that mainly produce capital goods used in manufacturing, resource extraction, and construction. Businesses in the industrial goods sector make and sell machinery, equipment, and supplies that are used to produce other goods rather than sold directly to consumers.

Utilities include large companies that offer multiple services such as electricity and natural gas or specialize in just one type of service, such as water. Some utilities rely on clean and renewable energy sources like wind turbines and solar panels to produce electricity.

Utilities typically offer investors stable and consistent dividends, coupled with less price volatility relative to the overall equity markets. As a result, utilities tend to perform well during recessions and economic downturns. Conversely, utility stocks tend to fall out of favor with the market during times of economic growth.

The energy sector is a large and all-encompassing term that describes a complex and interrelated network of companies involved in the production and distribution of energy needed to facilitate the means of production, businesses and individuals, and transportation. For the most part, energy companies are categorized based on how the energy that they produce is sourced and typically fall into one of two categories: renewable and non-renewable. The energy industry also includes secondary sources such as electricity.

Energy prices*—along with the earnings performance of energy producers—*are largely driven by the supply and demand for worldwide energy.

The Bloomberg 1-3 Month U.S. Treasury Bill Index is designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months. The Index includes all publicly issued U.S. Treasury Bills that have a remaining maturity of less than 3 months and at least 1 month, and are rated investment-grade. In addition, the securities must be denominated in U.S. dollars and must have a fixed rate. The Index is market capitalization weighted, with securities held in the Federal Reserve System Open Market Account deducted from the total amount outstanding..

Stats Since Inception

The goal of the Conservative Portfolio is to closely mirror the annual returns of the S&P 500 Market Index, but with much lower risk. This can be observed in the statistics below, from Jan 2000 to Jan 2024:

Compounded Annual Growth Rate (CAGR)

Higher is Better

The compounded annual growth rate (CAGR) is one of the most accurate ways to calculate and determine returns for any investment that can rise or fall in value over time. A higher CAGR means higher annual returns on average, which is preferable to most investors assuming all else is equal. Investors can compare the CAGR of two or more alternatives to evaluate how well one investment performed relative to another.

The Conservative Portfolio has a higher CAGR (8.50%) than the S&P 500's (7.18%), showing that over the last 24 years, the Conservative Portfolio slightly outperformed the SPY Market Index.

Average Monthly Returns

Higher is Better

Average Monthly Returns is the percent change that an investor should reasonably expect to see their portfolio rise or fall each month. A higher number is often regarded as better than a lower number because it implies higher compounded earnings over time.

The Conservative Portfolio increased 0.72% per month on average, compared to the SPY's 0.68% monthly average over the last 24 years.

Lower is Better

A Maximum Drawdown (MDD) is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period: in our case, 2000 - 2024. A low maximum drawdown is preferred as this indicates that losses from investment were small.

The Conservative Portfolio's Maximum Drawdown of -15.87% is significantly better than the S&P 500's Maximum Drawdown of -50.80%.

Worst Year

Lower is Better

Worst Year is the calendar-aligned year between 2000 and 2004 with the absolute worst performance. Most investors would prefer a lower Worst Year to a higher one, since a 'lower trough' implies a portfolio that declined less over a 12-month period than a another benchmark portfolio would have.

The Conservative Portfolio's Worst Year is more than twice as good as the S&P 500's: only -15.45% compared to -36.81%.

Higher is Better

The Sharpe ratio is a mathematical expression that helps investors compare the return of an investment with its risk. To calculate the Sharpe ratio, investors can subtract the risk-free rate of return from the expected rate of return, and then divide that result by the standard deviation (the asset's volatility.) The greater a portfolio's Sharpe ratio, the better its risk-adjusted performance.

The Conservative Portfolio's Sharpe ratio of 0.69 dominates the SPY's Sharpe Ratio of 0.41 over the same time period.

The Sharpe ratio can also help explain whether a portfolio's excess returns are attributable to smart investment decisions or simply luck and risk. For example, low-quality, highly speculative stocks can outperform blue chip shares for considerable lengths of time, as during the Dot-Com Bubble or the meme stocks rally. For example, if a YouTuber happens to beat Warren Buffett in the market for a while, the Sharpe ratio quickly provides a reality check by adjusting both of their performances by their portfolio's volatilities.

Higher is Better

The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative portfolio returns—downside deviation—instead of the total standard deviation of portfolio returns. Because the Sortino ratio focuses only on the negative deviation of a portfolio's returns from the mean, it is thought to give a better view of a portfolio's risk-adjusted performance, since positive volatility is a benefit.

Just like the Sharpe ratio, a higher Sortino ratio result is better. When looking at two similar investments, a rational investor would prefer the one with the higher Sortino ratio because it means that the investment is earning more return per unit of the bad risk that it takes on.

The Conservative Portfolio's Sortino Ratio of 1.10 eclipses the SPY's Sortino Ratio of 0.59 over the same time period.

.png)